maine sales tax calculator

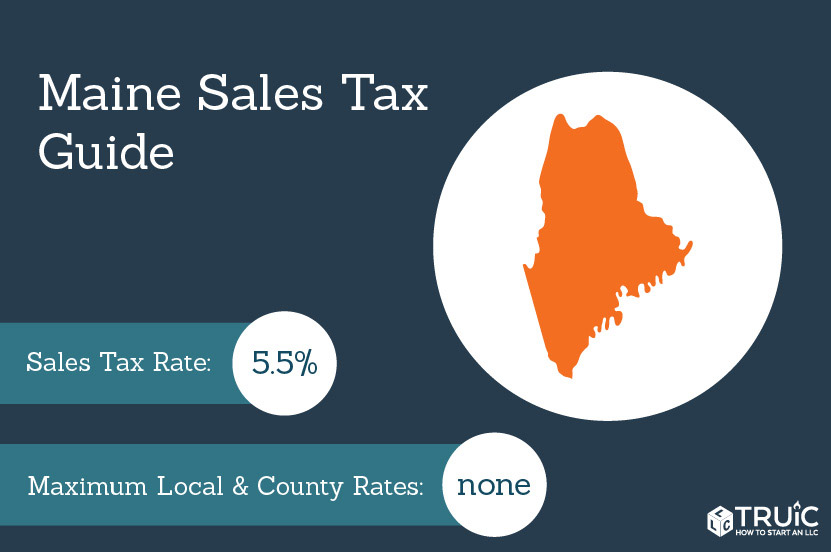

The Maine ME state sales tax rate is currently 55. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

The goods news is that Maine sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies.

. Exact tax amount may vary for different items. Sales and Use Tax Rates. Affidavits Applications.

Sales Tax calculator Maine. Groceries and prescription drugs are exempt from the Maine sales tax. The average cumulative sales tax rate in Auburn Maine is 55.

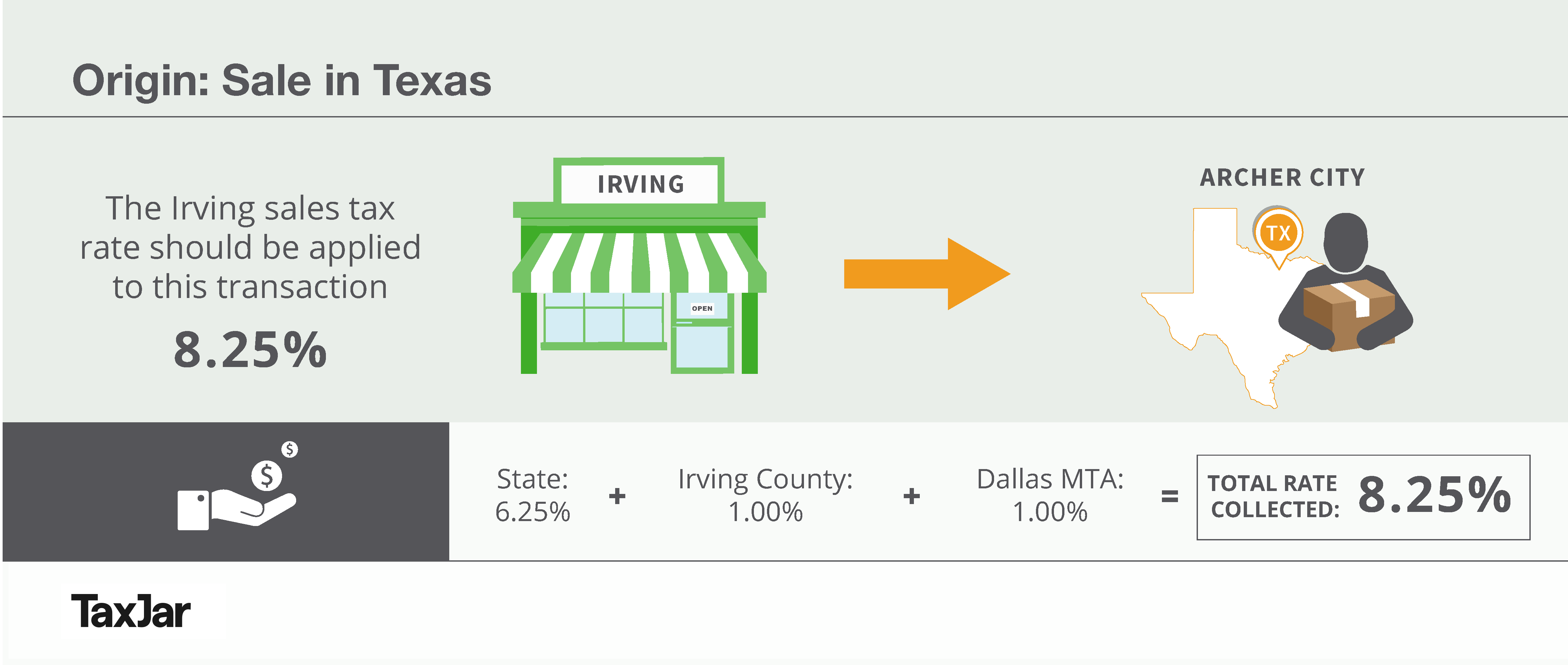

Our income tax calculator calculates your federal state and local taxes based on several key inputs. So whilst the Sales Tax Rate in Nevada is 685 you can actually pay anywhere between 685 and 827 depending on the local sales tax rate applied in the municipality. No Maine cities charge a local income tax.

The state has a high standard deduction that helps low- and middle-income Mainers at tax time. This includes the rates on the state county city and special levels. This includes the rates on the state county city and special levels.

Maximum Possible Sales Tax. Maine does not apply County Local or Special Sales Tax Rates tso the Total Sales Tax applied across the State of Maine is 55 you can calculate Sales Tax online using the. Thats why we came up with this handy Maine sales tax calculator.

From the list below for specific Nevada Sales Tax Rates for each location in 2022 or calculate the. Maine levies taxes on tangible personal property which includes physical and digital products as well as some services. 3d printing lift z.

Retailers can then file an amended return at a later date to reconcile the correct tax owed. This includes the rates on the state county city and special levels. Golf cart rental ocean view nj.

Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Maine has a progressive income tax system that features rates that range from 580 to 715. So whether you live in Maine or outside Maine but have nexus and sell to a customer there you would charge your customer the 55 sales tax rate on most transactions.

For example if you purchase a new vehicle in Maine for 40000 then you will. It is 4951 of the total taxes 49 billion raised in Maine. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate.

The state sales tax rate is 55 and Maine doesnt have local sales tax rates. Average Local State Sales Tax. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

The average cumulative sales tax rate in Bowdoin Maine is 55. The average cumulative sales tax rate in Portland Maine is 55. This includes the rates on the state county city and special levels.

Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov. Maine Sales Tax Exempt Organizations. 2022 Maine state sales tax.

Sales and Use Tax Rates Due Dates Rates. Avalara provides supported pre-built integration. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

If youve opened this page and reading this chances are you are living in Maine and you intend to know the sales tax rate right. Sales tax is not collected at the local city county or ZIP in Maine making it one of the easier states in which to manage sales tax collection filing and remittance. This includes the rates on the state county city and special levels.

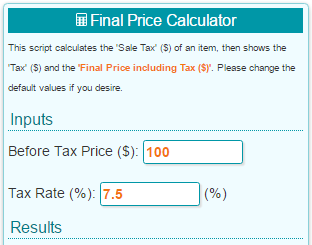

Sales and Gross Receipts Taxes in Maine amounts to 24 billion. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or salestaxmainegov.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Find your Maine combined state and local tax rate. That said some items like prepared food are taxed differently.

Bowdoin is located within Sagadahoc County MaineWithin Bowdoin there is 1 zip code with the most populous zip code being 04287The sales tax rate does not vary based on zip code. The average cumulative sales tax rate in Brunswick Maine is 55. Augusta is located within Kennebec County MaineWithin Augusta there are around 5 zip codes with the most populous zip code being 04330The sales tax rate does not vary based on zip code.

The tax that is levied on lodging and prepared food is 8 and furthermore the short-term auto rental is 10. The car sales tax in Maine is 550 of the purchase price of the vehicle. The average cumulative sales tax rate in Augusta Maine is 55.

Counties and cities are not allowed to collect local sales taxes. Sales Tax Rate s c l sr. Portland is located within Cumberland County MaineWithin Portland there are around 9 zip codes with the most populous zip code being 04103The sales tax rate does not vary based on zip code.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maine local counties cities and special taxation. Office of Tax Policy. Well speaking of Maine there is a general sales tax of 55.

Numbers represent only state taxes not federal taxes. Your household income location filing status and number of personal exemptions. Rate Type Effective 102013 Effective 012016 Effective 012017 Effective 02012018.

Auburn is located within Androscoggin County MaineWithin Auburn there are around 3 zip codes with the most populous zip code being 04210The sales tax rate does not vary based on zip code. Food and prescription drugs are exempt in Maine while prepared food lodging and auto rentals. Brunswick is located within Cumberland County MaineWithin Brunswick there is 1 zip code with the most populous zip code being 04011The sales tax rate does not vary based on zip code.

Maine Sales Tax Rates. Maine sales tax details. Overview of Maine Taxes.

This state sales tax also applies if you purchase the vehicle out of state.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Sales Tax By State Is Saas Taxable Taxjar

Maine Vehicle Sales Tax Fees Calculator

Maine Vehicle Sales Tax Fees Calculator

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

How To Calculate Cannabis Taxes At Your Dispensary

Maine Sales Tax Small Business Guide Truic

Maine Sales Tax Table For 2022

How To Charge Your Customers The Correct Sales Tax Rates

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Item Price 90 Tax Rate 18 Sales Tax Calculator

State Corporate Income Tax Rates And Brackets Tax Foundation

Maine Estate Tax Everything You Need To Know Smartasset

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price